Tesla (TSLA) releases its earnings after the US market closes on Wednesday, and investors will want to see the current stock decline end.

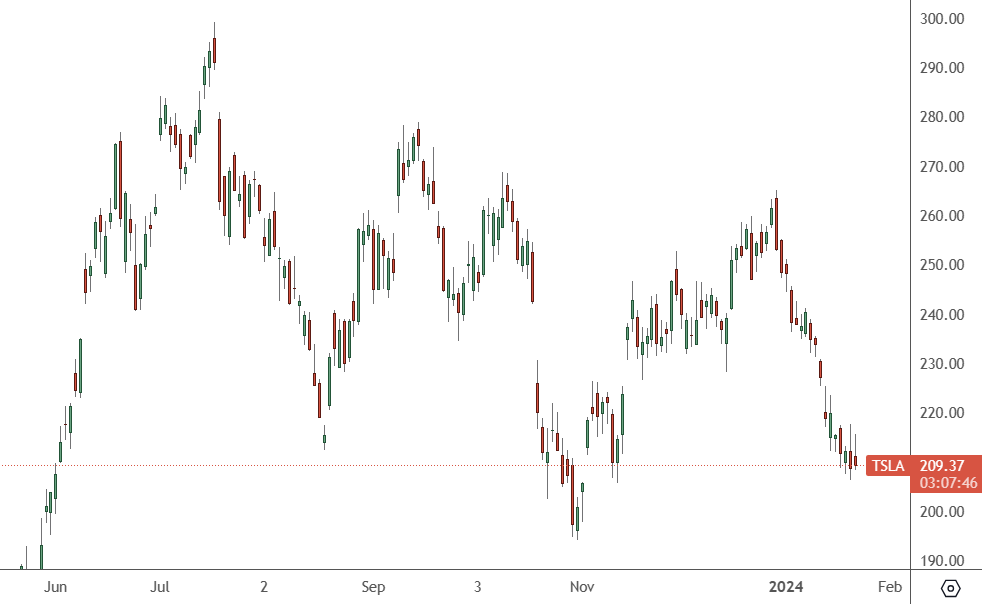

TSLA – Daily Chart

TSLA shares have dropped to $209.37 and have support at the $200 level. It is hard to see a fast rebound from these levels.

Analysts at Wedbush said that price cuts in 2023 were the correct move to ensure healthy demand, given increasing competition and higher production rates. However, they also questioned whether Elon Musk’s firm could continue its cost-cutting strategies or if it would keep slashing prices to ensure margin stability amid a worrying decline in EV demand.

Analyst Daniel Ives said, “In our view, Tesla’s pricing path will be a foundational move for its future over the coming years.”

Ives said that the long-term bull call for Tesla was built around its disruptive technology, such as the charger network, battery advancements, and AI.

“This would make it difficult for the stock to shed this black cloud in the near term,” said Ives. Tesla shares were substantial in 2023, more than doubling in price, despite being one of the year’s most shorted stocks by hedge funds.

“We still anticipate Tesla to maintain its long-term 50% unit growth, which is more procedural at this point rather than true guidance for the coming year,” said Ives.

“The line in the sand around margins must be drawn on Wednesday to give investors the hittable bogeys and targets for 2024 and then start the next phase of the Tesla growth story through this near-term period of supply glut and uncertainty for EVs,” Ives noted.

However, the stock is down 15% in 2024, and fears are building. Recent data from S3 Partners showed that after Apple and Microsoft, Tesla is the third-most shorted stock on the S&P 500, with short interest totalling over $18 billion.