The US Dollar index is strong ahead of Wednesday’s Federal Reserve interest rate meeting.

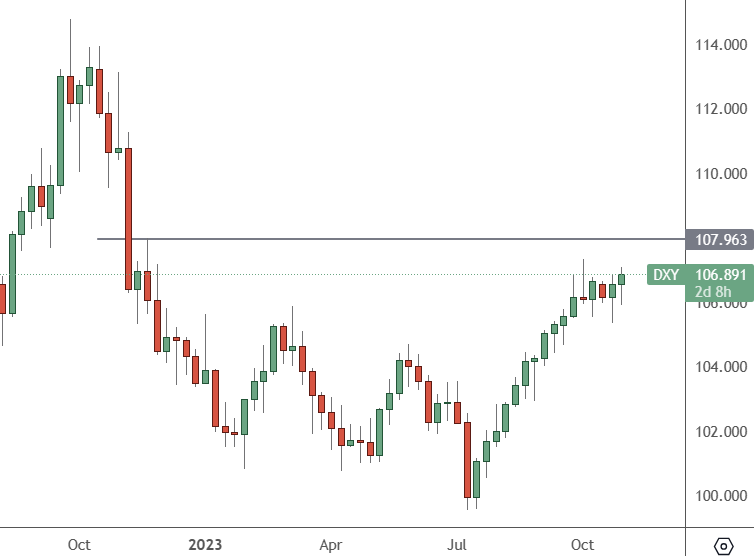

USD Index – Weekly Chart

The US Dollar index is trading at 106.89 with a resistance level of 17.96, which capped a bounce a year ago. A move above that could see further strength in the USD, and there are geopolitical risks that could help power the move.

The Federal Reserve interest rate decision comes ahead of the jobs report on Friday in what should be an important week for the USD. The dollar index tracks the currency against a basket of the world’s major currencies and sets the mood for currency markets.

Strength in the DXY since July has been driven by the market unwinding their bets that the Fed will cut rates. We also have geopolitical risks and the US currency’s haven status.

The yield on the 10-year US Treasury has dipped below 4.8% ahead of the Fed after threatening to hit 5%—Wednesday morning. The drop came after the Treasury Department announced its quarterly refunding plans, which involve auctioning a smaller amount of debt than investors expected. Investors were caught off guard by a more significant issuance in the previous quarter.

The rise in those yields was a significant factor in recent comments from Fed officials who have suggested that the central bank does not need to raise rates when the market forces are doing that job.

Traders will look at Friday’s jobs report after the Fed meeting, but the signs still show a substantial market for workers. The number of job openings in the country climbed again in September, according to data this week from the Bureau of Labor Statistics.

There were an estimated 9.5 million available jobs in September, according to the BLS’ latest report. That marked the second month when the number of job openings increased.

The jobs market and treasury yields are providing upward momentum in the US, and any further outbreak of conflict in the Middle East would add to the dollar’s haven status.