Regional banks were a hot topic earlier in the year after the Silicon Valley Bank collapse.

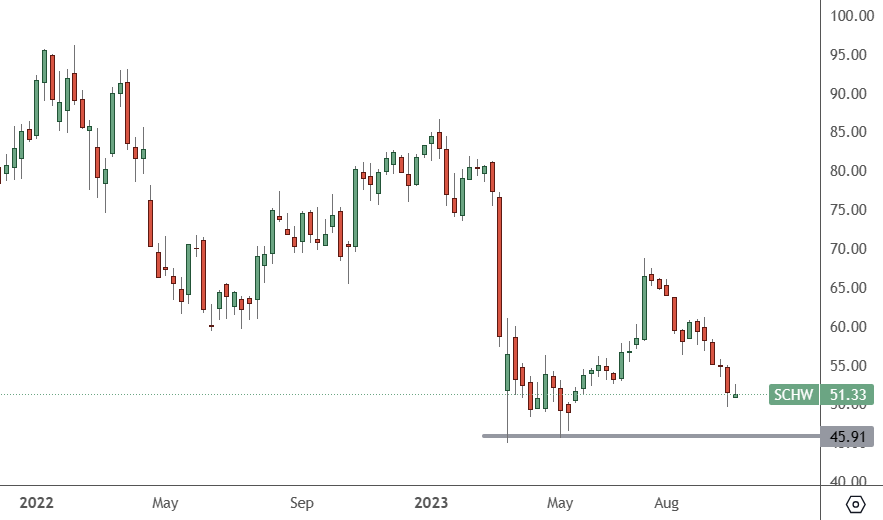

SCHW: Weekly Chart

Shares in Charles Schwab (SCHW) have been on the decline since the turn of the year and may test the lows at $45.90.

Schwab’s Liz Ann Sonders said she believes there are risks but does not see the Federal Reserve cutting rates soon.

Charles Schwab released figures for Q3 on October 16, with analysts predicting earnings of $0.741 per share compared to earnings of $1.10 per share in the same quarter of the previous year. Wall Street is expecting to see sales of $4.64 billion, a decrease of 15.6% over the prior year.

Yearly earnings per share are set at $3.14, compared to $3.90 per share in the previous year. On average, analysts are expecting revenue of $19.16 billion, compared to $20.76 billion last year.

Schwab was a company caught up in the collapse of Silicon Valley Bank, with some questioning its survival. During the SVB panic, investors pointed to its February 2023 monthly activity report, which revealed a 28% decline in margin balances and a 4% decline in total client assets compared to the same month of 2022.

Charles Schwab reassured investors that it had “access to significant liquidity,” adding that “more than 80%” of its deposits were covered by the Federal Deposit Insurance Corporation’s insurance limits.

Investors will take a keen interest in these smaller financial institutions this week as earnings come out, and they could rattle the market if there are cracks.