Factors Influencing Currency Valuation

Supply and Demand

Like any other asset, the value of any foreign currency is influenced by basic principles surrounding the law of supply and demand. If there is a high demand for a currency, its value will likely increase. Just the opposite, if there is an oversupply of a currency, its value may decrease.

Interest Rates

Central banks set interest rates, which can affect a currency’s value. Higher interest rates tend to attract foreign investors looking for better returns on their investments, leading to an increased demand for that currency. This can drive up its value. Conversely, lower interest rates may lead to a decrease in currency value.

Economic Indicators

Various economic indicators, such as gross domestic product (GDP), inflation rate, unemployment rate, and trade balance, can impact currency valuation. Strong economic performance can boost confidence in a currency, leading to its appreciation, while weak economic data can have the opposite effect.

Political Stability

Political stability and a well-functioning government can positively influence a currency’s value. Investors are more likely to invest in a country with stable political conditions, leading to increased demand for its currency.

Market Speculation

Traders and investors in the forex market often speculate on the future direction of currency values based on a variety of factors. This speculation can lead to short-term fluctuations in currency values.

Trade Balance

A country’s trade balance, which is the difference between its exports and imports, can impact its currency’s value. A trade surplus (more exports than imports) can lead to increased demand for the country’s currency, driving up its value.

Market Sentiment

Public perception and sentiment about a country’s economic conditions, prospects and political stability can influence currency valuation. Positive sentiment can lead to a stronger currency, while negative sentiment can lead to a weaker currency.

Market Intervention

Central banks and governments can intervene in the foreign exchange market to influence their currency’s value. They might buy or sell their own currency to stabilise the exchange rate or to achieve other economic objectives. its value or achieve specific economic goals.

Global Events

Geopolitical events, natural disasters, and other global developments can impact currency values by affecting investor confidence and risk perception.

Capital Flows

The movement of capital in and out of a country can influence its currency’s value. A country that attracts significant foreign investment may experience an increase in its currency’s value.

Currency valuation is a dynamic and complex process, and these factors often interact in intricate ways. It’s important to note that currencies are typically valued relative to one another; changes in the value of one currency will affect exchange rates with other currencies. Traders, investors, governments, and central banks closely monitor these factors to make informed decisions about currency trading and policy.

Exchange Rates

Exchange rates are the prices at which one currency can be exchanged for another. They are determined by supply and demand in the foreign exchange market, which is a global marketplace where currencies are bought and sold. The exchange rate between two currencies can fluctuate based on a variety of factors, including economic conditions, political stability, and interest rates.

Methods for Measuring Currency Valuation

By monitoring exchange rates, you can assess the relative strength or weakness of a currency. A strong currency is one that is worth more than other currencies, while a weak currency is worth less. The strength or weakness of a currency can have a significant impact on a country’s economy, as it can affect the cost of imports and exports, as well as the value of foreign investment.

Trade-Weighted Index

A trade-weighted index is a measure of a currency’s value against a basket of other currencies, weighted according to the importance of each currency in a country’s trade. This index provides a broader view of a currency’s value by taking into account its performance against multiple trading partners. For example, if a country imports a lot of goods from the United States and exports a lot of goods to China, then the trade-weighted index will be more sensitive to changes in the value of the US dollar and Chinese yuan than it would be to changes in the value of other currencies.

Trade-weighted indexes are used by businesses and investors to track the value of a currency against its major trading partners. They can also be used to measure the competitiveness of a country’s exports.

Purchasing Power Parity (PPP)

Purchasing Power Parity (PPP) is an economic theory that suggests that the exchange rate between two currencies should equalise the prices of a basket of goods and services in each country. It is a way of measuring the value of a currency in terms of its purchasing power in another country. By comparing the actual exchange rate to the PPP exchange rate, you can determine whether a currency is overvalued or undervalued.

For example, if the PPP exchange rate between the US dollar and the euro is 1.25, this means that a basket of goods and services that costs €1 in the eurozone would cost $1.25 in the United States. If the actual exchange rate is 1.10, this means that the euro is overvalued against the dollar, as it would take fewer dollars to buy the same basket of goods and services in the eurozone than it would in the United States.

PPP is often used to compare the living standards of different countries. It can also be used to forecast future exchange rates.

Real Effective Exchange Rate (REER)

The real effective exchange rate (REER) is a measure of the value of a country’s currency relative to the currencies of its trading partners, adjusted for inflation. It is calculated by taking the nominal exchange rate between two currencies and multiplying it by the ratio of the price levels in the two countries. The REER can be used to assess a country’s competitiveness in international trade. A rising REER indicates that a country’s currency has become more expensive relative to the currencies of its trading partners, making it more difficult for domestic businesses to compete in international markets. A falling REER indicates that a country’s currency has become cheaper relative to the currencies of its trading partners, making it easier for domestic businesses to compete in international markets. The REER is often used by governments and businesses to track a country’s competitiveness in international trade. It can also be used to predict future changes in trade flows.

Economic Indicators

Economic indicators, such as inflation rates, interest rates, GDP growth, and trade balances, can provide insights into a currency’s value. For example, a country with low inflation and strong economic growth is likely to have a stronger currency. This is because investors are more likely to invest in countries with stable economies and low inflation.

Additionally, a country with a strong trade balance will have more money coming in from exports than it is spending on imports. This can also lead to a stronger currency. However, it is important to note that measuring currency valuation is not an exact science and involves a degree of subjectivity. There are many factors that can affect the value of a currency, and it can be difficult to predict how these factors will change in the future.

Different methods may yield different results, and it’s often necessary to consider multiple indicators to get a comprehensive view. Additionally, currency valuation is influenced by a wide range of factors, as mentioned in the article, so it’s important to take a holistic approach when assessing currency value.

The Federal Reserve (FED)

The Federal Reserve (often referred to as the Fed) is the central bank of the United States and plays a significant role in influencing currency valuation through its monetary policy decisions. Here’s how the Federal Reserve can affect currency valuation:

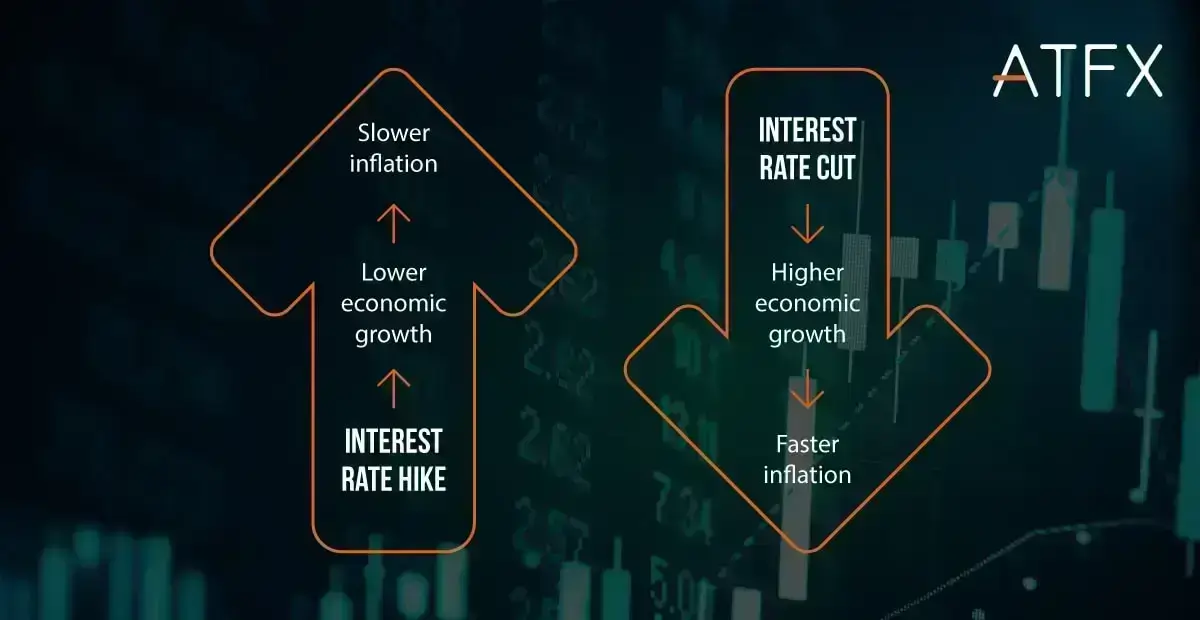

Interest Rates

One of the primary tools the Federal Reserve uses to influence currency valuation is its control over interest rates. By raising or lowering the federal funds rate (the rate at which banks lend money to each other), the Fed can influence borrowing costs for consumers, businesses, and investors.

Higher interest rates tend to attract foreign capital seeking higher returns, leading to increased demand for the US dollar and potentially strengthening its value.

In contrast, lower interest rates can reduce the attractiveness of the dollar, potentially leading to depreciation.

Open Market Operations

The Federal Reserve conducts open market operations, which involve buying or selling US government securities in the open market.

When the Fed buys securities, it injects money into the economy, increasing the money supply. This can potentially lead to a weaker dollar due to increased supply.

Conversely, when the Fed sells securities, it absorbs money from the economy, potentially strengthening the dollar.

Quantitative Easing (QE)

In times of economic downturn or financial stress, the Federal Reserve may engage in quantitative easing. This involves purchasing large quantities of assets, such as government bonds or mortgage-backed securities. The goal is to stimulate economic activity by increasing the money supply and lowering interest rates.

While QE can lead to a weaker dollar due to increased money supply, its impact on currency valuation can be complex and influenced by various other factors.

Forward Guidance

The Federal Reserve communicates its future monetary policy intentions through statements and press conferences.

The market’s perception of future interest rate changes and policy direction can influence currency valuation. If the Fed signals a more hawkish stance (indicating potential interest rate increases), the dollar might strengthen. Conversely, a more dovish stance (indicating potential interest rate cuts) could weaken the dollar.

Central Bank Communication

The speeches, statements, and remarks made by Federal Reserve officials can have a significant impact on currency markets. Any indications of shifts in policy direction, economic outlook, or concerns about inflation can lead to currency fluctuations.

Market Confidence

The Federal Reserve’s actions and statements can influence investor confidence in the US economy.

Positive perceptions of the economy can attract foreign investment, potentially strengthening the dollar.

Global Impact

The Federal Reserve’s actions can also impact other countries’ economies and currencies. Since the US dollar is a global reserve currency, changes in its value can have ripple effects on international trade, financial markets, and global economic conditions.

Inflation’s Impact on Currency Valuation

The Consumer Price Index (CPI) is indirectly related to currency valuation through its influence on inflation. Currency valuation is influenced by a variety of factors, and inflation is one of the key economic indicators that can impact how a currency is valued in the foreign exchange market. Here’s how CPI relates to currency valuation:

Inflation and Purchasing Power Parity (PPP)

Inflation is a general increase in prices and fall in the purchasing value of money. Purchasing power parity (PPP) is a theory which states that in the long run, exchange rates should adjust so that identical goods in different countries have the same price when expressed in a common currency.

If the CPI of one country is consistently higher than that of another country, it implies that the first country is experiencing higher inflation and its currency’s purchasing power is eroding relative to the second country’s currency. This can lead to a depreciation of the first country’s currency in the foreign exchange market.

For example, if the CPI in the United States is 2% and the CPI in China is 5%, then the purchasing power of the US dollar is eroding relative to the Chinese yuan. This means that a US dollar can buy less in China than it could before. This can lead to a depreciation of the US dollar in the foreign exchange market, making it cheaper for Chinese people to buy US goods and services.

PPP is a useful tool for understanding exchange rates, but it is important to remember that it is just a theory. There are many factors that can affect exchange rates, and PPP does not always hold true in the short run.

Interest Rates and Inflation Differentials

Central banks often use interest rates to control inflation. When a country’s CPI rises, the central bank might respond by raising interest rates to curb inflationary pressures. Higher interest rates make it more expensive to borrow money, which can help to slow down economic growth and reduce inflation.

Additionally, higher interest rates can attract foreign investment seeking better returns, leading to increased demand for that country’s currency and potentially strengthening its value.

Contrarily, if a country has persistently high inflation and its central bank maintains lower interest rates, it might lead to a weaker currency as investors are less likely to hold assets denominated in that currency due to lower returns and increased inflation risk.

Inflation differentials can also affect currency exchange rates. When inflation is higher in one country than in another, the currency of the country with higher inflation is likely to depreciate against the currency of the country with lower inflation. This is because investors are more likely to hold assets denominated in the currency of the country with lower inflation, as they will be more likely to keep their value over time.

Impact on International Trade

Inflation affects a country’s competitiveness in international trade in a number of ways.

First, if a country’s inflation rate is higher than that of its trading partners, its goods and services may become relatively more expensive in global markets. This can lead to reduced demand for its exports, potentially resulting in a trade imbalance.

Second, inflation can also lead to a decrease in the value of a country’s currency, which can make its exports even more expensive and imports cheaper. This can further worsen a trade imbalance.

Finally, inflation can also lead to uncertainty and volatility in the global economy, which can discourage investment and trade.

Overall, inflation can have a significant negative impact on a country’s international trade. It can make it more difficult to compete in global markets, can lead to a trade imbalance, and can discourage investment and trade.

Market Expectations and Central Bank Policies

Market expectations and central bank policies are two of the most important factors that influence currency markets. If the CPI data releases are consistently higher or lower than expected, it can affect investor perceptions of a country’s economic health and potential policy responses from its central bank. This, in turn, can impact currency valuation.

For example, if a country’s CPI data releases are consistently higher than expected, it could signal that the country’s economy is overheating. This could lead investors to believe that the central bank will raise interest rates in order to combat inflation. This, in turn, could cause the country’s currency to appreciate.

Conversely, if a country’s CPI data releases are consistently lower than expected, it could signal that the country’s economy is struggling. This could lead investors to believe that the central bank will lower interest rates in order to stimulate growth. This, in turn, could cause the country’s currency to depreciate.

It is important to note that market expectations are not always accurate. However, they can still have a significant impact on currency markets.

Currency Fluctuations and Imported Inflation

The value of a currency is determined by supply and demand. When the demand for a currency is high, its value will appreciate. When the demand for a currency is low, its value will depreciate. This can have a significant impact on the cost of imported goods and services.

- If a country’s currency appreciates, it will take less of that currency to buy goods and services from other countries. This can lead to lower prices for imported goods and services.

- If a country’s currency depreciates, it will take more of that currency to buy goods and services from other countries. This can lead to higher prices for imported goods and services.

Inflation is a measure of the rate at which prices for goods and services are rising.

CPI inflation is a measure of the rate at which prices for a basket of consumer goods and services are rising.

A country’s currency can have a significant impact on CPI inflation. If a country’s currency appreciates, it can lead to lower prices for imported goods and services, which could contribute to lower CPI inflation.

To the contrary, a depreciating currency might lead to higher imported inflation as the cost of imported goods increases.

Global Investment Flows

Inflation differentials between countries can influence global investment flows. Investors may seek to allocate their investments to countries with lower inflation rates to protect their purchasing power. This can influence the demand for different currencies in the foreign exchange market.